GST came into effect in India from 1st July 2017. For smooth implementation of the system the GST Network(GSTN) was already closely partnering with the accounting and software enterprises which will help bridge this transition.

The GSTN had identified 32 such companies and were designated the status of GST Suvidha Provider(GSP). GSP’s have been given special access to the GST api's and can build services on top it to directly integrate and smooth the return filing for the end users.

We were approached by IRIS Business Services Ltd. almost a month before the GST came into affect, to develop invoicing software which then directly files return with the help of their api services directly into the GST servers without the need of the user to login into the GST portal.

The primary challenge in this was freezing the scope of the project, as the requirements were changing rapidly almost every week as new format & parameters were surfacing after studying the GST guidelines shared by the government.

Major milestones

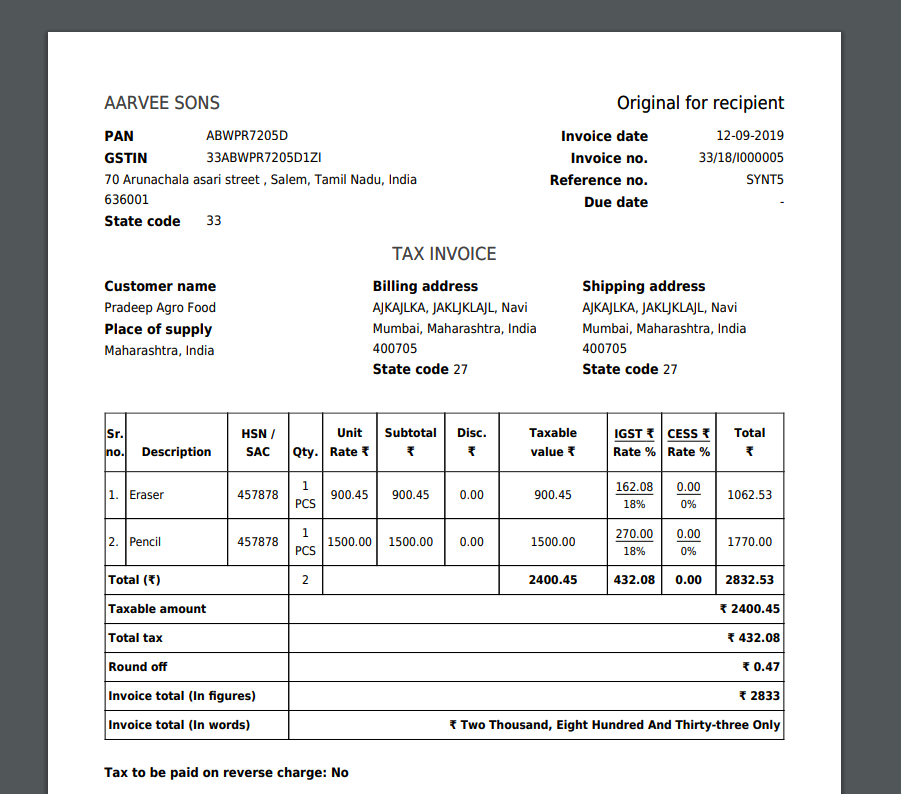

Pixel Perfect invoice print

We first tried with html invoice preview, though we realized that downloading an exact pdf of the html will not be possible technically. Hence we later improvised to directly print pdf version of the invoice.

Import of invoices

Building invoice import to add as well as update invoices in the system was a major challenge. The issue was setting up the key identifier to be linked with particular invoice and adding multiple item lines against the same invoice number.

GST excel export

Here the hard work was thorough study of the default export formats suggested by the GST council and understanding the linkages between all the tax document.

Following documents are covered under this software

-

Sales documents

-

Tax Invoice

-

Credit & debit note

-

Debit Note

-

Bill of supply

-

Advance receipt

-

Tax paid

-

Advanced received aggregate

-

Tax paid aggregate

-

Payment Receipt

-

-

Purchase documents

-

Purchase invoice

-

Credit & debit notes

-

Advance paid

-

Tax paid on purchases

-

Advance paid aggregate

-

Tax paid aggregate

-

Payment made

-

If you are looking for an invoicing solution, signup for AimcorERP – our one stop solution for all your business automation tools. Let’s empower your team.

At ADEPTSTATION we have follow agile methodology for customized software development and you can also hire dedicated resources for your next project with us. Shoot us an email at [email protected] and let us together execute your vision.

If you are developer and looking out for a job, feel free to drop your resume at [email protected].